Sarbanes Oxley (SoX)

Streamline Sarbanes Oxley Compliance

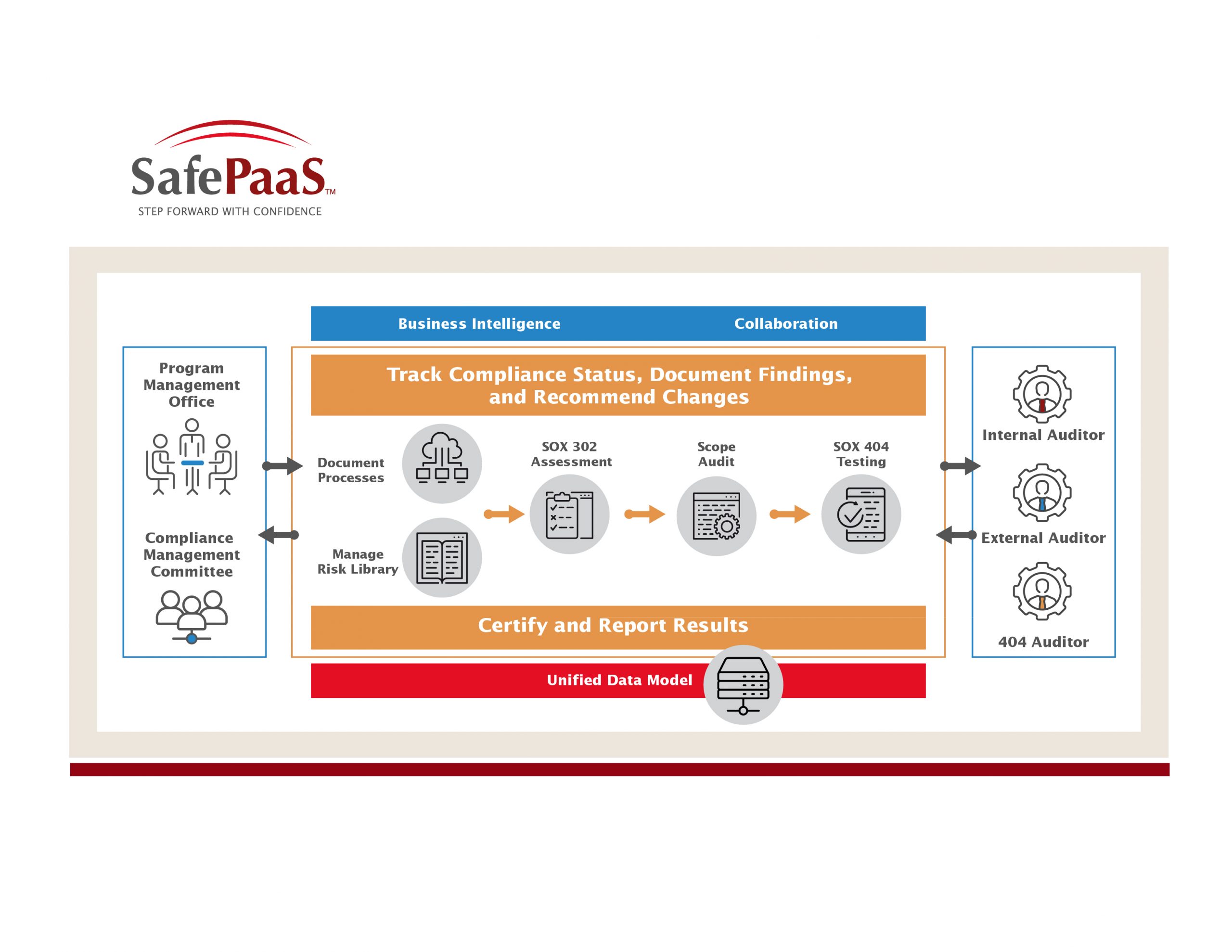

Streamline Compliance Management Program

Reduce Cost of Compliance:

Quickly and reliably comply with the full range of compliance requirements

Automate self-assessment, controls evaluation, and management certification processes

Improve visibility into issue and remediation activities with monitors and dashboards

The Sarbanes–Oxley Act of 2002, enacted July 30, 2002, also known as Sarbox or SOX, is a United States federal law enacted on July 30, 2002, which set new or enhanced standards for all U.S. public company boards, management and public accounting firms. It is named after sponsors U.S. Senator Paul Sarbanes (D-MD) and U.S. Representative Michael G. Oxley (R-OH).

The bill was enacted as a reaction to a number of major corporate and accounting scandals including those affecting Enron, Tyco International, Adelphia, and WorldCom. These scandals, which cost investors billions of dollars when the share prices of affected companies collapsed, shook public confidence in the nation's securities markets. The act contains 11 titles, or sections, ranging from additional corporate board responsibilities to criminal penalties, and requires the Securities and Exchange Commission (SEC) to implement rulings on requirements to comply with the new law. It created a new, quasi-public agency, the Public Company Accounting Oversight Board, or PCAOB, charged with overseeing, regulating, inspecting and disciplining accounting firms in their roles as auditors of public companies.

SafePaaS Enterprise Compliance Manager enables management testing as required by compliance regulations. The compliance framework can be configured for various industry and regulatory frameworks such as AML, Basel II, COSO, Cobit, FCPA, FISMA, FERC, HIPAA, NCR, OMB-123, OSHA, PCI DSS and Solvency II. SafePaaS Business Ontology Analytics extracts data from enterprise data sources such as SAP, Oracle E-Business Suite, PeopleSoft, and J D Edwards as well as internal control databases to improve testing effectiveness and findings across the enterprise in a single integrated solution. The SafePaaS GRC DataProbe™ collects testing samples from ERP systems and stores control evidence in the SafePaaS GRC DataHub™. Interactive dashboards for real-time corrective action modeling allow business managers to explore risk exposure in an ad hoc manner.

The bill was enacted as a reaction to a number of major corporate and accounting scandals including those affecting Enron, Tyco International, Adelphia, and WorldCom. These scandals, which cost investors billions of dollars when the share prices of affected companies collapsed, shook public confidence in the nation's securities markets. The act contains 11 titles, or sections, ranging from additional corporate board responsibilities to criminal penalties, and requires the Securities and Exchange Commission (SEC) to implement rulings on requirements to comply with the new law. It created a new, quasi-public agency, the Public Company Accounting Oversight Board, or PCAOB, charged with overseeing, regulating, inspecting and disciplining accounting firms in their roles as auditors of public companies.

SafePaaS Enterprise Compliance Manager enables management testing as required by compliance regulations. The compliance framework can be configured for various industry and regulatory frameworks such as AML, Basel II, COSO, Cobit, FCPA, FISMA, FERC, HIPAA, NCR, OMB-123, OSHA, PCI DSS and Solvency II. SafePaaS Business Ontology Analytics extracts data from enterprise data sources such as SAP, Oracle E-Business Suite, PeopleSoft, and J D Edwards as well as internal control databases to improve testing effectiveness and findings across the enterprise in a single integrated solution. The SafePaaS GRC DataProbe™ collects testing samples from ERP systems and stores control evidence in the SafePaaS GRC DataHub™. Interactive dashboards for real-time corrective action modeling allow business managers to explore risk exposure in an ad hoc manner.