FINANCIAL MANAGEMENT

Record to Report

Report Financial Results with Confidence

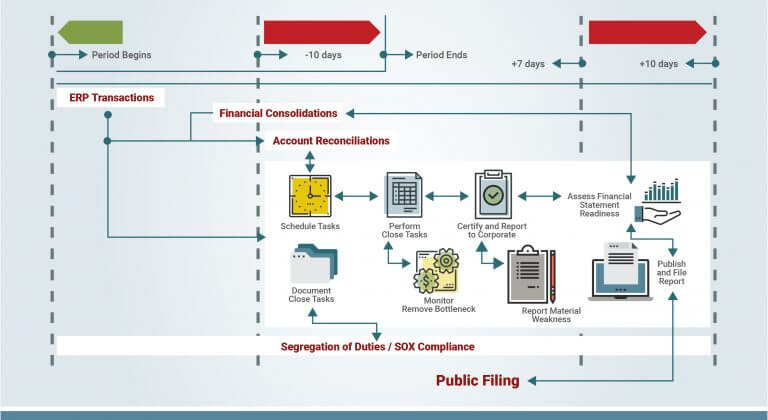

Streamline Period-End Close:

Replace error prone manual period-end check lists

Improve financial staff productivity with automated reconciliation

Resolve account variances before reporting financial results

Improve Period-End close process by replacing manual checklists and procedures with a simple web-based task preparation, review and approval of each step in the close process. Monitor your close calendar activities such as list of manual journals, departmental tasks, SOX compliance controls. You can setup task frequencies (weekly, monthly or quarterly, etc.), due dates relative to the accounting period end dates, and times, allowing tasks to be scheduled at precise intervals. The CFO and Global Controller can monitor progress throughout the close with drill-down into a tasks level to verify that tasks are executed in order and on time.

Automatically conduct variance and fluctuation analyses with a rules-driven process that monitors all balance fluctuations. Enforce reason codes for the appropriate account owners when rules are violated, eliminating the need for manual follow-up with phone calls and email. You can monitor variance types for Budgeted vs. Actual, Forecasted vs. Actual, YTD, month-over-month, quarter-over-quarter, year-over-year, and quarterly comparisons. In addition you can roll-up variance types for financial reporting and maintain flexible variance grouping.

Set up reconciliation workflows and monitor the reconciliation process to save many hours during the period-end close. You can track the ownership and status of each reconciliation task, across many periods. You can access the reconciliation web page to easily the reconcile accounts and attach supporting documents to preserve the audit-trail and mitigate missstatement risks. You can monitor the status of the account reconciliation process and generate reports. Any risk of aging items or delinquent reconciliations can be mitigated with email alerts. This approach eliminates the need to keep paper binders thus making the audits easier and quicker.

Contact us to learn more about Record to Report controls including: The GL Account Test of Reasonableness, Manual Journal Entries Over Threshold Amount, Fluctuation in Gross Margin by Amount, Fluctuation in Financial Statements Accounts, Use the Bank Charges window to specify charges associated with transferring money between banks, the region or state you assign to paid invoice distribution lines for a 1099 supplier, controls to specify the general ledger accounts for transactions that you enter manually or import from another source.