Continuous monitoring across O2C business process

Ensure customer orders data quality and track key performance metrics

Prevent risks and investigate recovery opportunities to improve revenue generation, margins and profitability

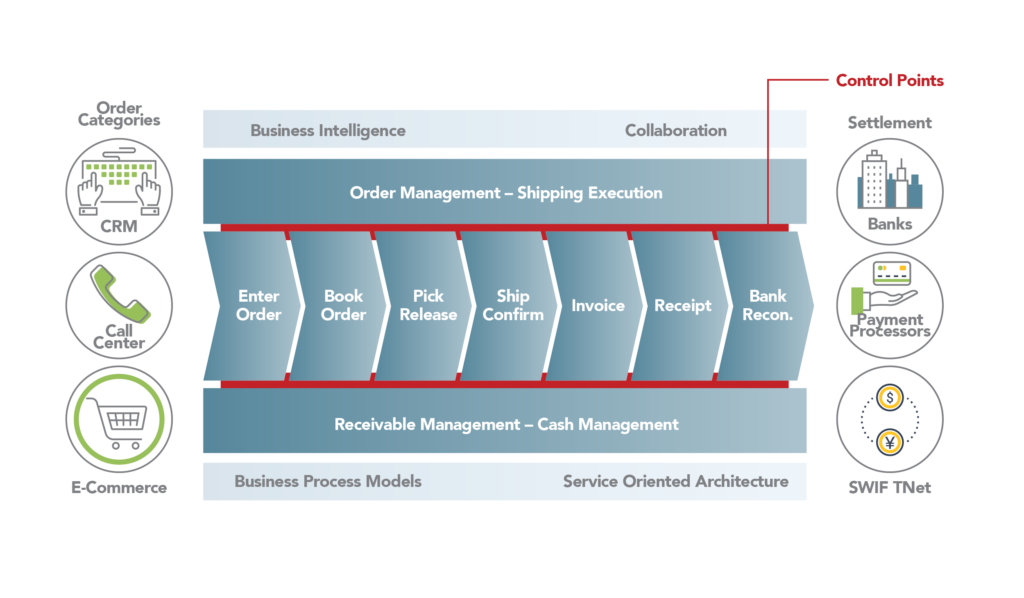

Revenue leakage is a real problem facing many industries, especially where the revenue management chain is complex. “Revenue leakage amounts to 9% of an enterprise’s revenues.” – 45% of executives see revenue leakage as a systematic problem for their companies, according to a 2020 survey by Boston Consulting Group. The Order to Cash (O2C) cycle spans several functional areas of the organization which includes external providers such as credit rating agencies and credit card processors. The control gaps in the underlying systems are therefore prone to revenue leakage through fraud, errors, or mismanagement. Organizations are subject to additional losses through penalties if the revenue recognition method does not comply with guidelines issued by FASB, IASB, etc.

Thank you for reaching out. If you have any questions, inquiries, or require assistance, please don’t hesitate to contact us using the form below. A member of our team will respond to your message as promptly as possible.